Time to Protect Those Who Matter Most

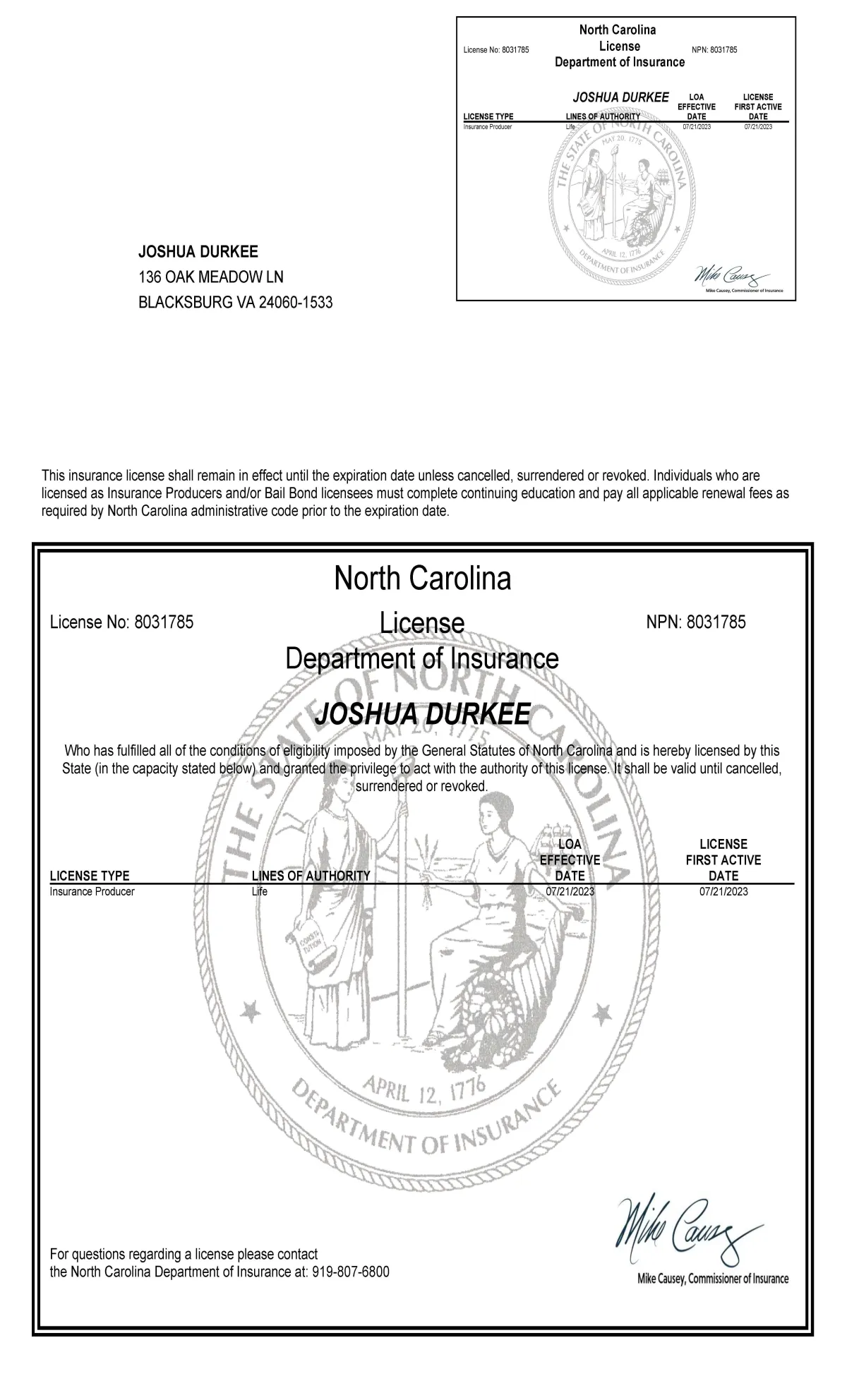

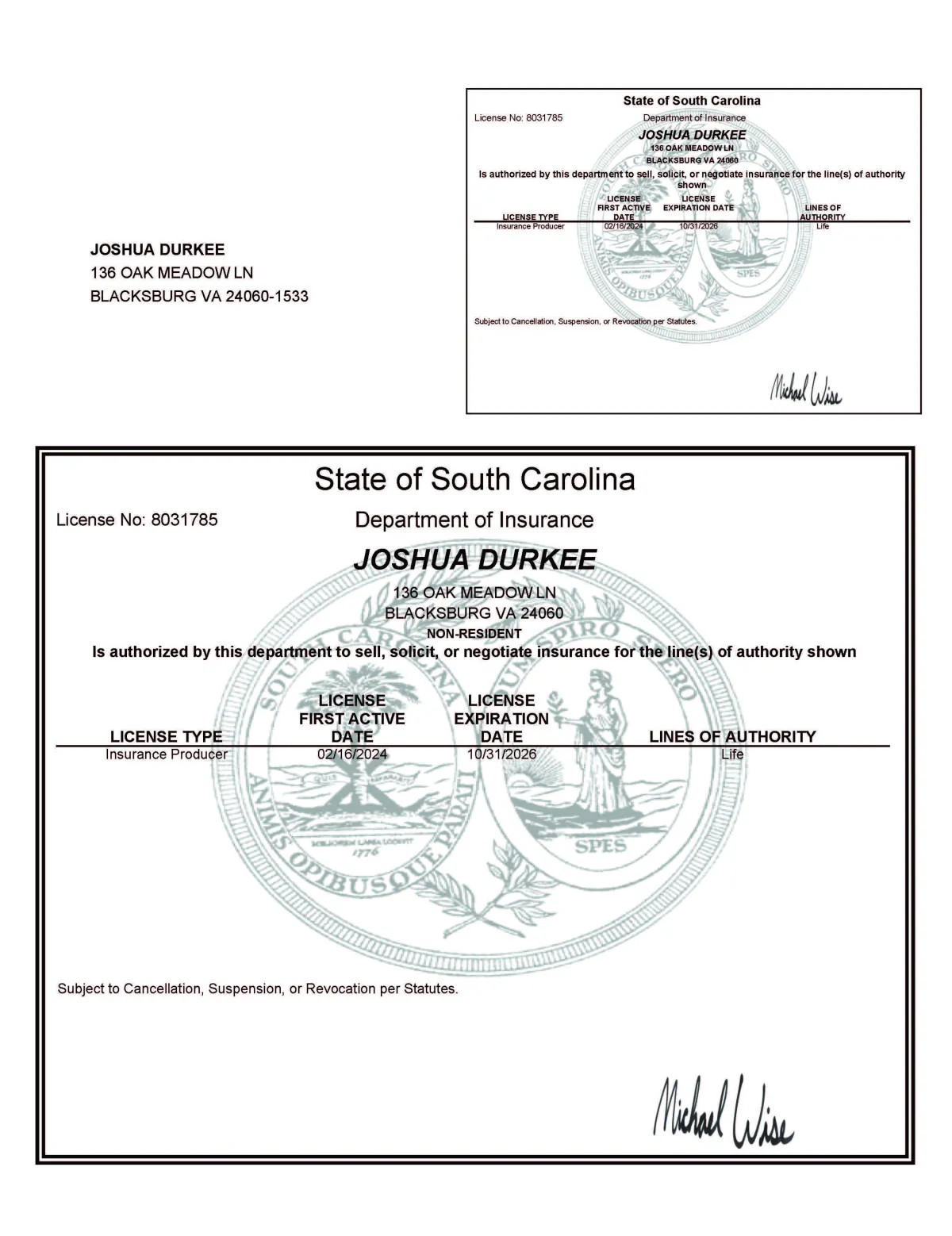

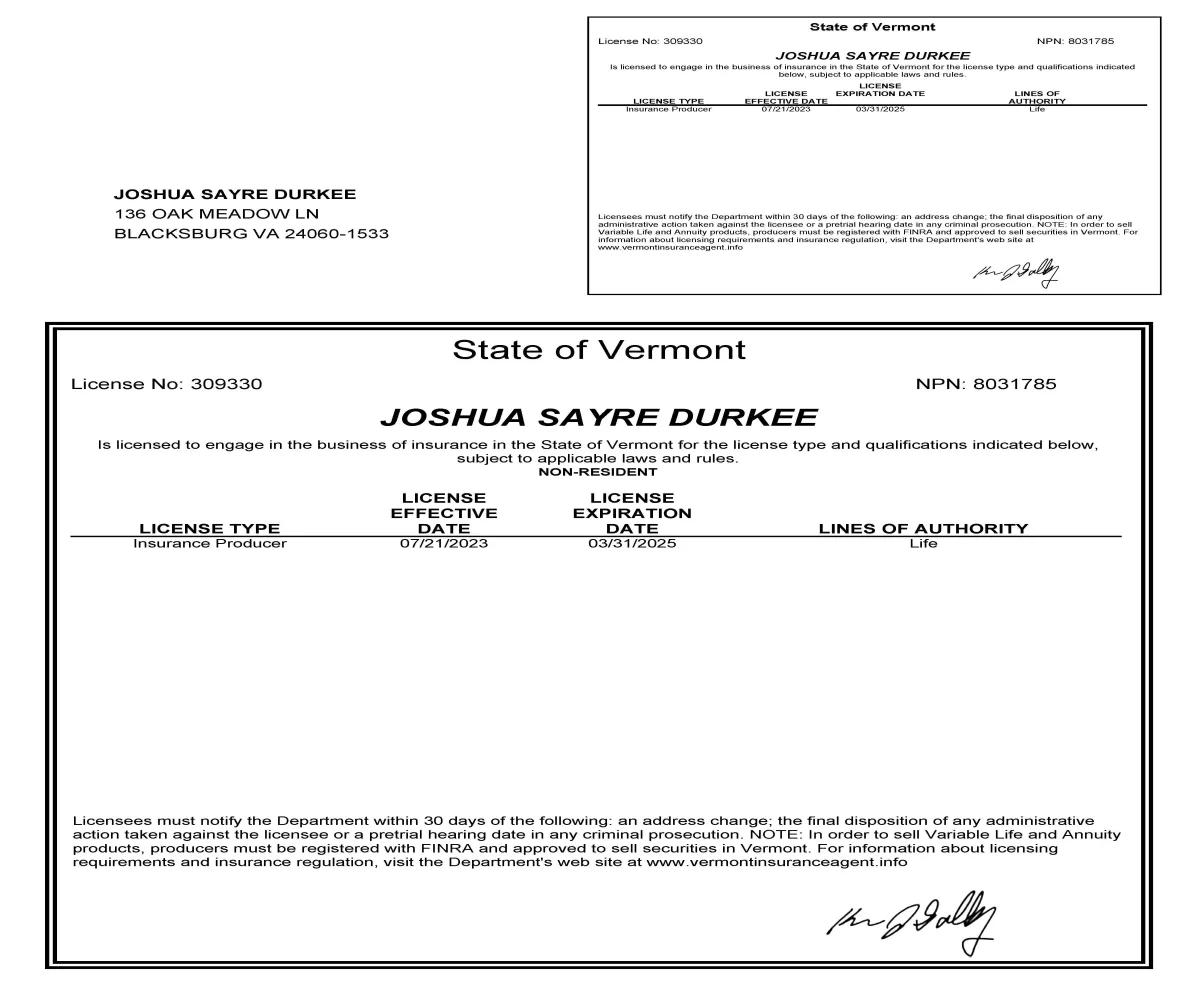

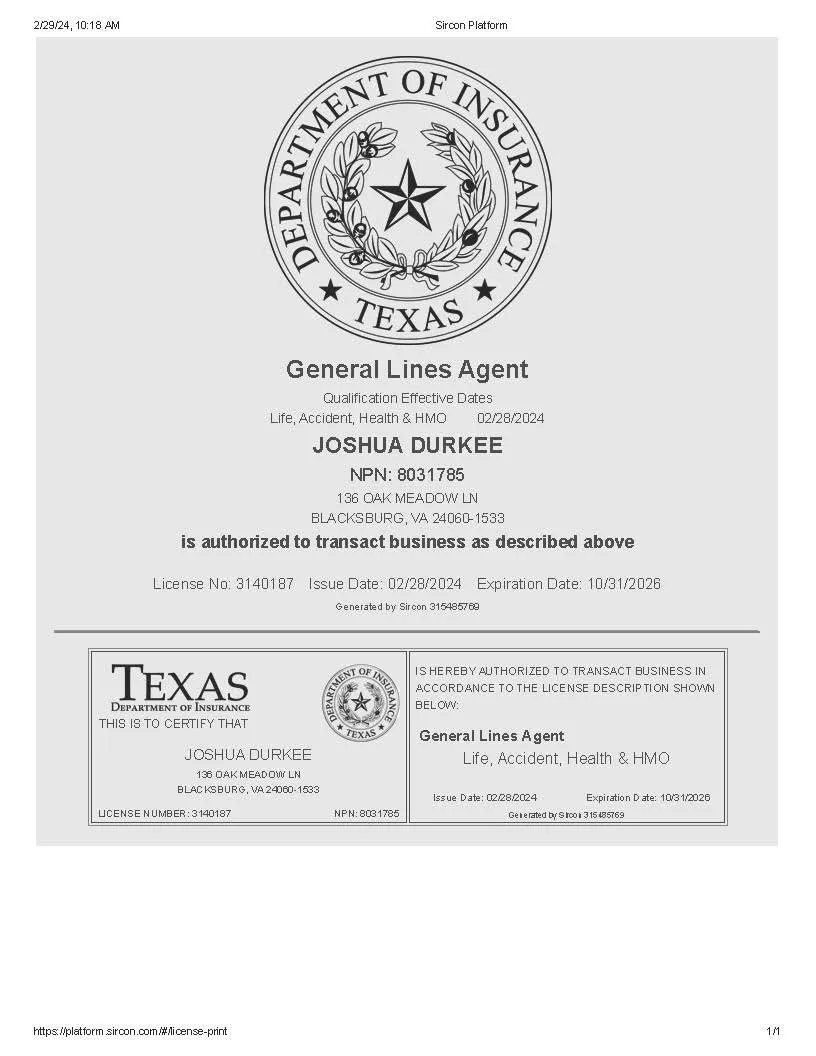

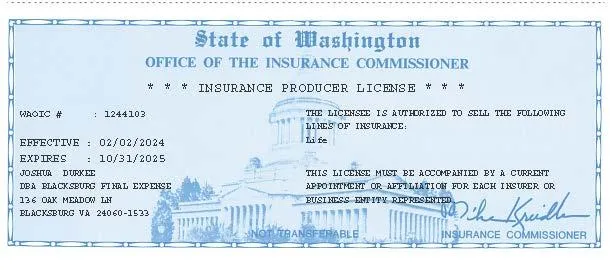

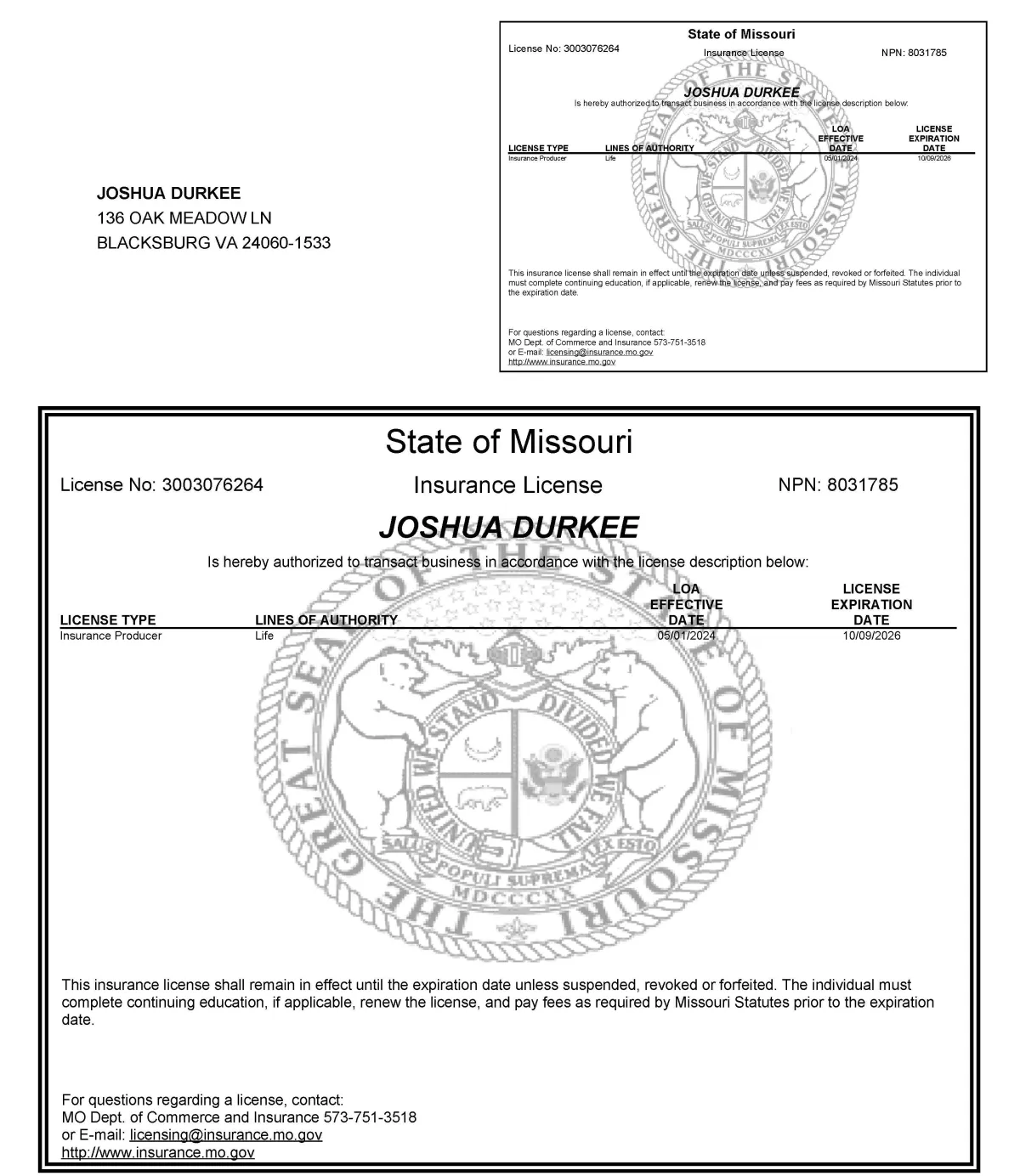

Joshua Durkee

Licensed Broker & Senior Field Underwriter

National Producer #: 8031785

Final Expense

Final Expense insurance will cover you for life. Prices are locked and will never increase nor will your policy end. These policies are designed to ensure all funeral and other end-of-life expenses are covered.

Mortgage Protection

Mortgage protection insurance is a way to protect one of your most valuable assets in the event of a death. In the event of a death, the mortgage will be paid in full, so your family can keep the house

Indexed Universal Life

This type of permanent policy allows the insured to accumulate cash value in addition to their death benefit. It can be set up to help supplement your retirement plan with tax free finances at retirement.

Fixed Indexed Annuities

This is a safe way to participate in the market's gains while avoiding potential losses and securing your retirement.

Term Insurance

Term life insurance provides protection for a specific period of time (the term). This is often 10, 20 or 30 years. Term life insurance makes sense when you need protection for a specific amount of time--for instance, until your kids graduate from college or your mortgage is paid off.

Term life insurance typically offers the most amount of coverage for the lowest initial premium. This makes this type of life insurance policy a good choice for those on a tighter budget.

Whole Life Insurance

Whole life insurance provides lifelong protection for as long as you pay the premiums. It also accumulates cash value on a tax-deferred basis, which you can tap into to buy a home, supplement your retirement income, cover an emergency expense and more.

Because of these additional benefits, initial premiums are higher than what you’d pay for a term life insurance policy with the same amount of coverage.

Disability Income

Think about it. What would happen if suddenly, due to an illness or injury, you were unable to work? The ability to earn a living is far and away most people’s largest “asset.” Learn how to protect your income if you become unable to work in the event of an injury or illness.

Business Over Head Expense

BOE provides money to cover business expenses when you are sick on injured and unable to work.

What You’ll Get During This Free Consultation

During your call, you will be able to sit with a licensed professional who will be able to find you not only the best solution for your current situation but also at the best price available. No two people are the same, and neither should your coverage. Let Joshua help you to find your best options available.

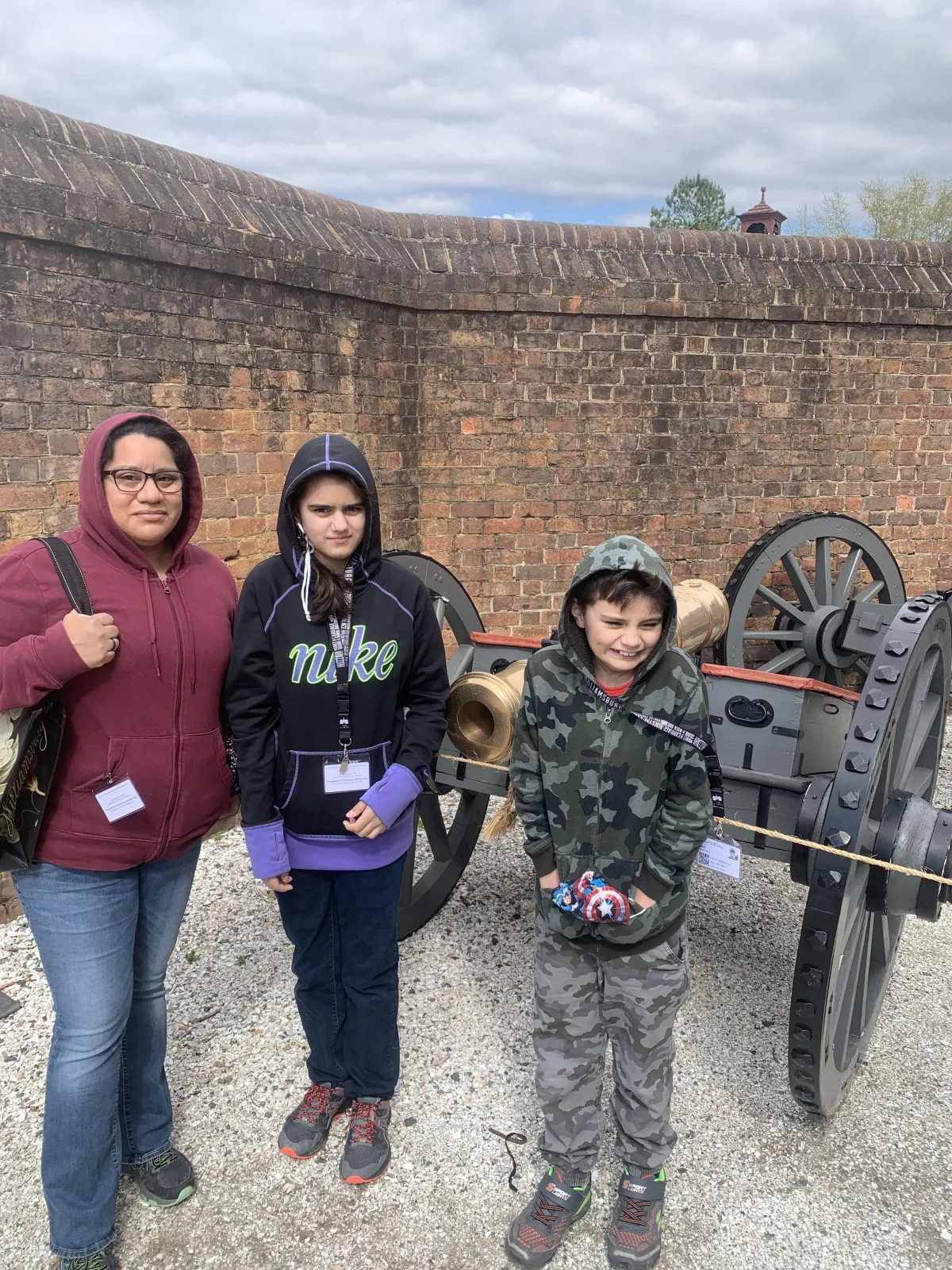

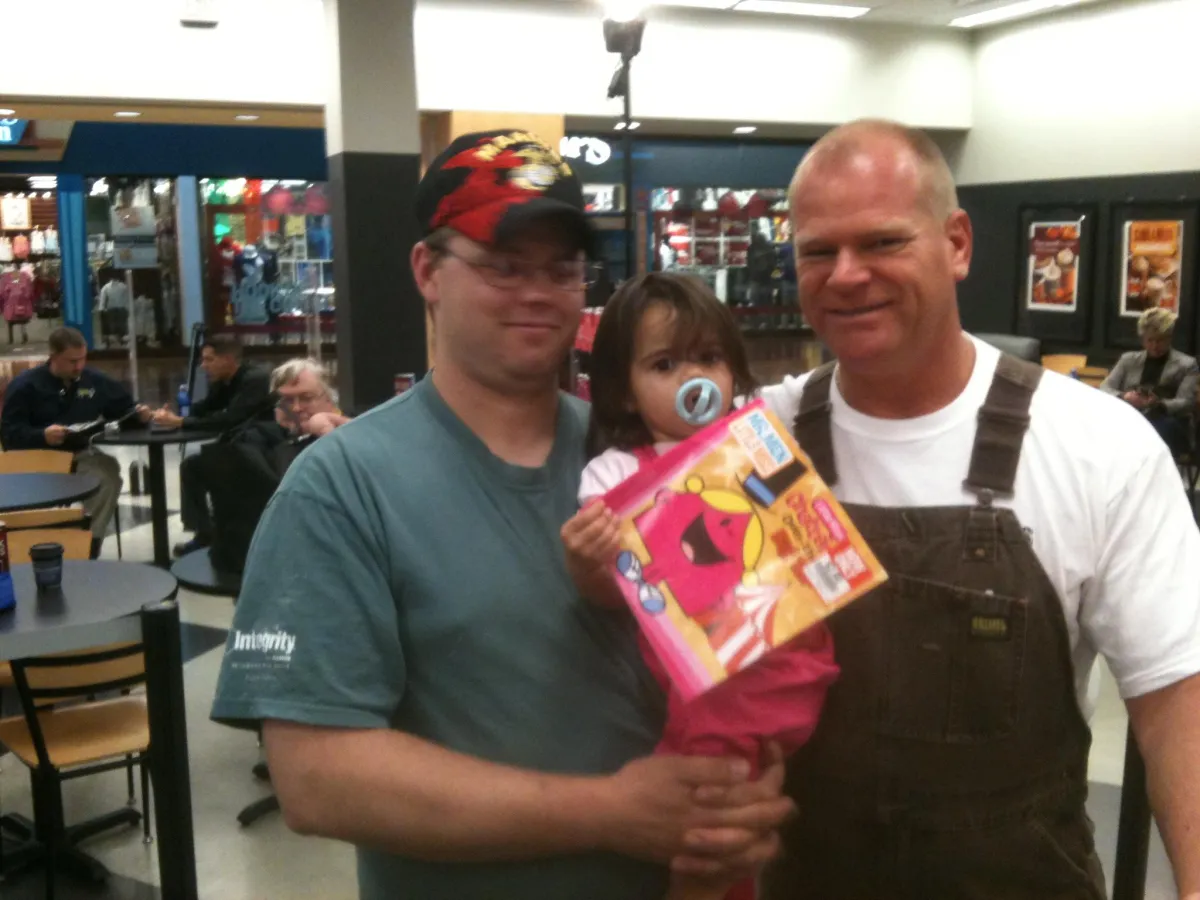

About Joshua Durkee

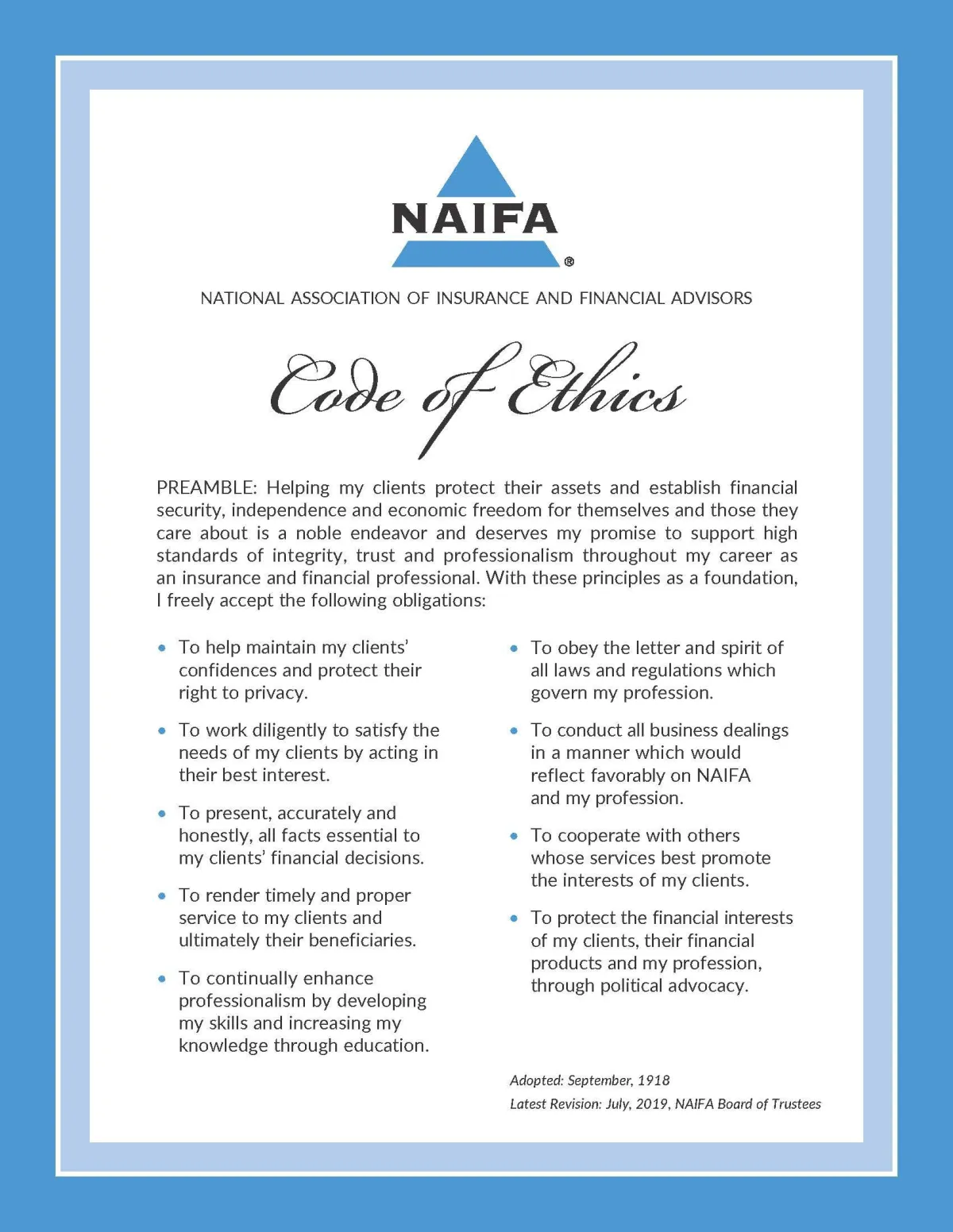

Josh has been protecting families and businesses like yours for over 6 years, as a second generation insurance professional. As a member of NAIFA (National Association of Insurance and Financial Advisor) Josh has committed to their code of ethic, always putting the client first. Whether you need help with a final expense policy, saving to retirement with an IUL, ensuring you business can continue, or just need a budget friendly term plan to protect your babies we can take care of you. Don't hesitate to call, we are always happy to help service our community.

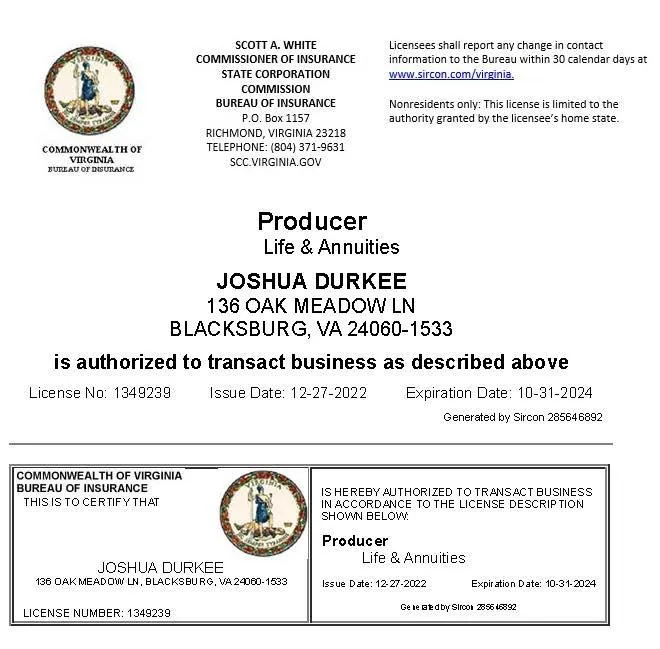

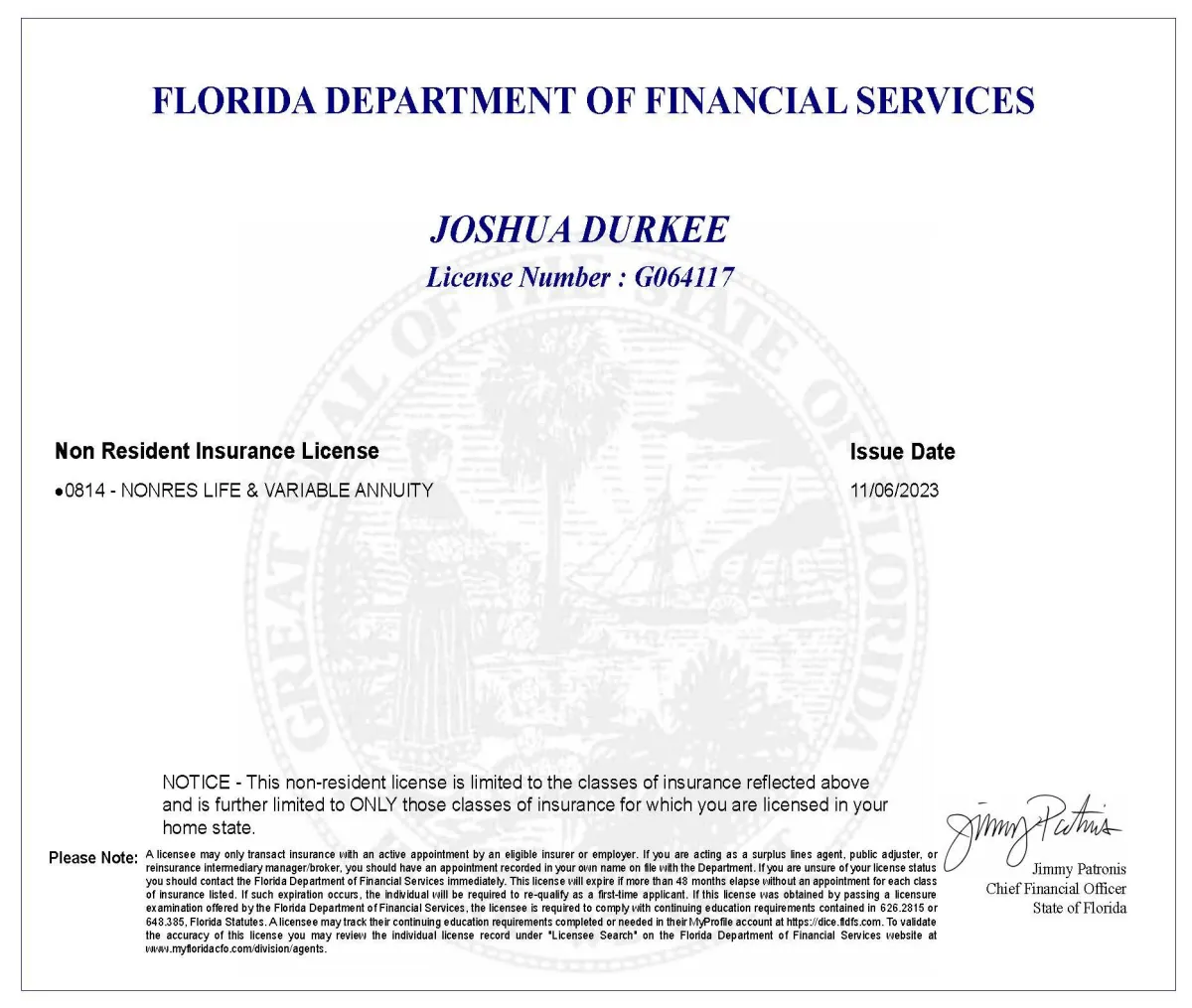

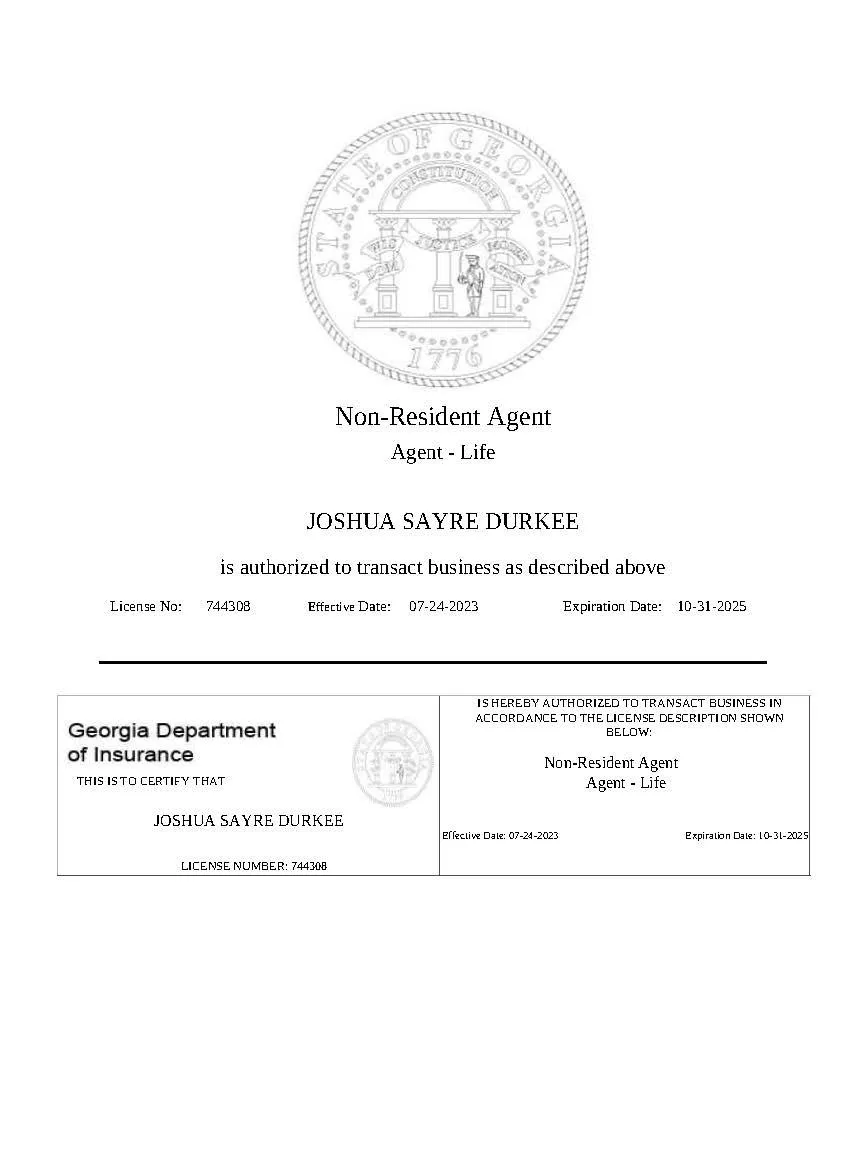

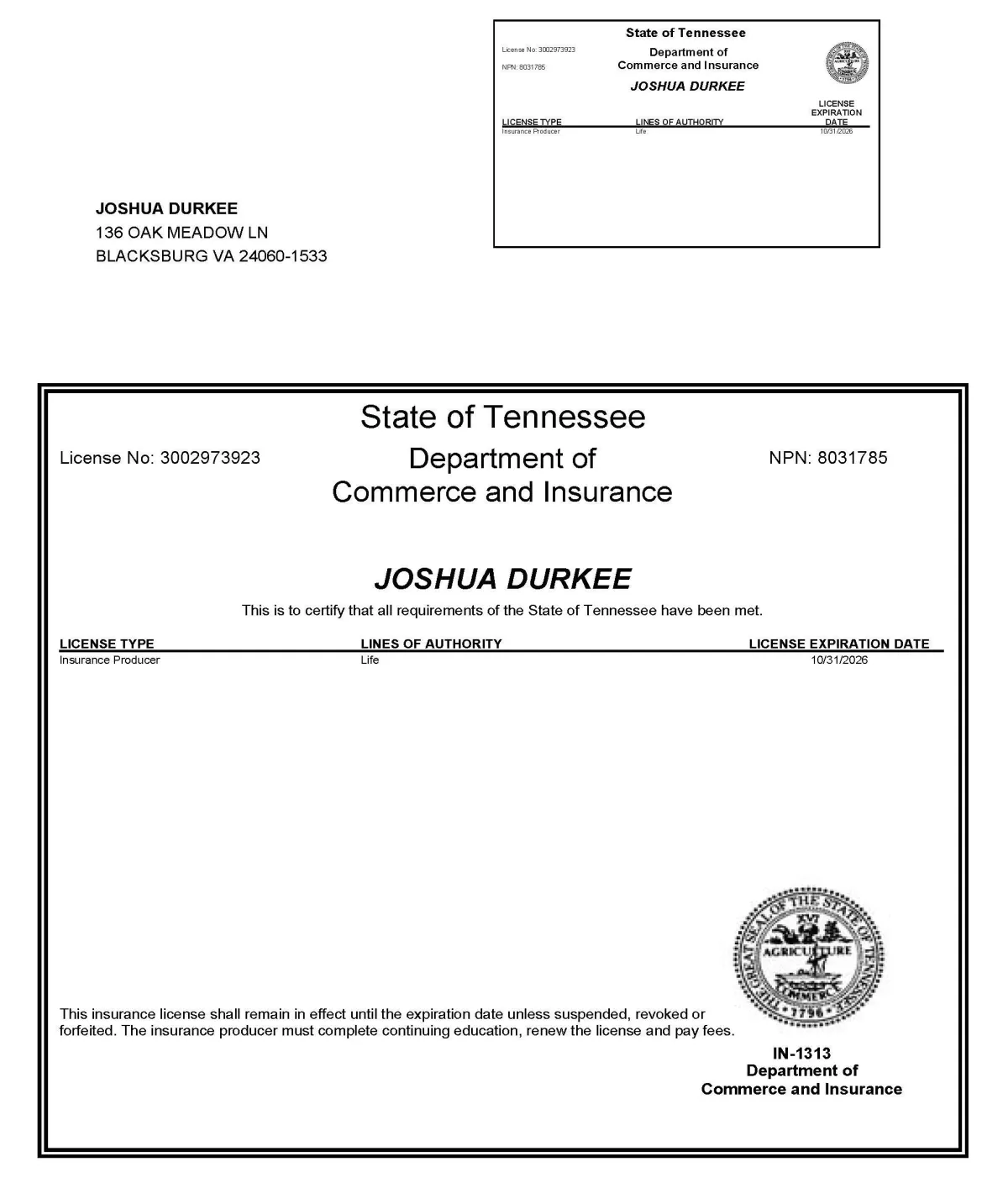

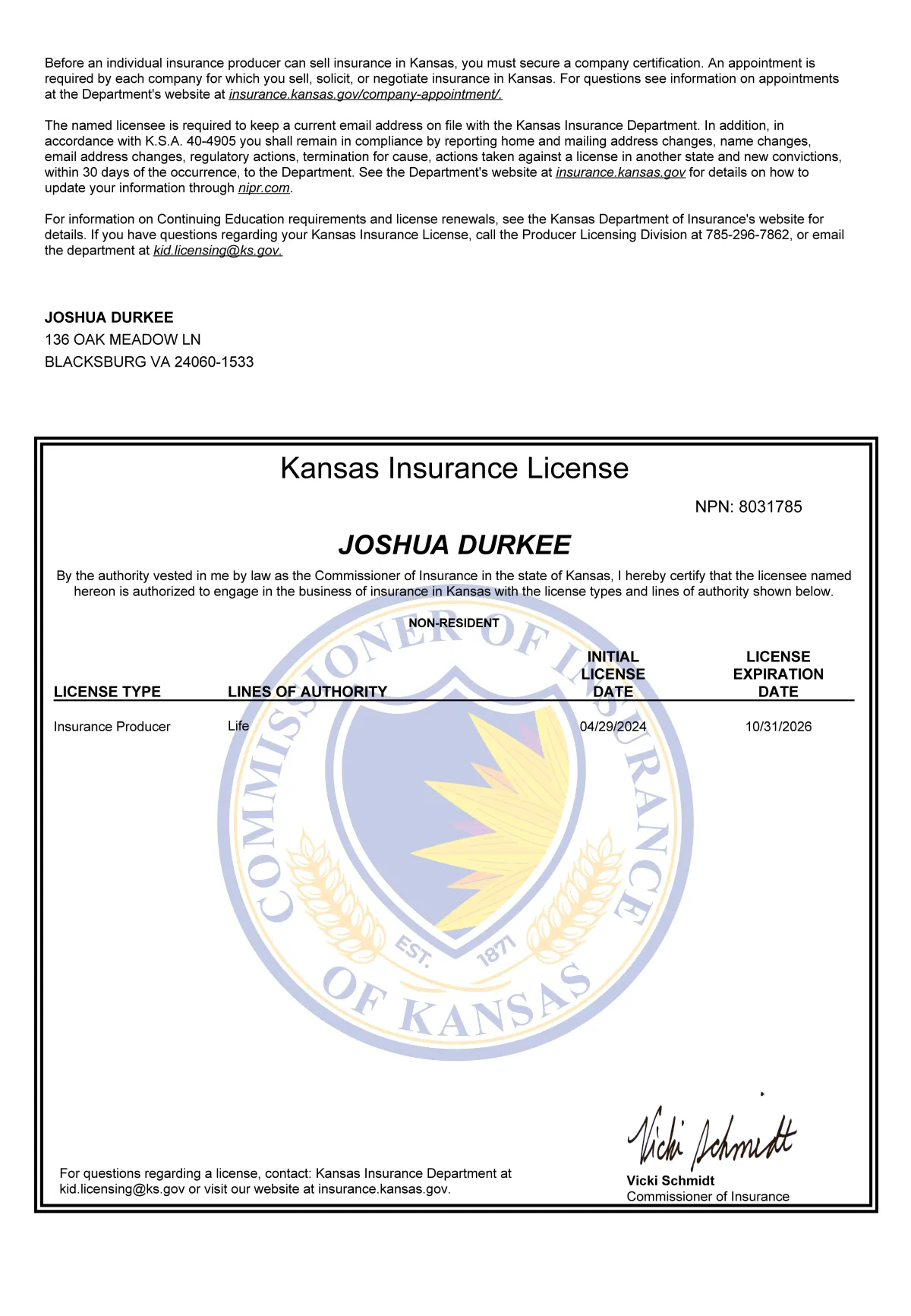

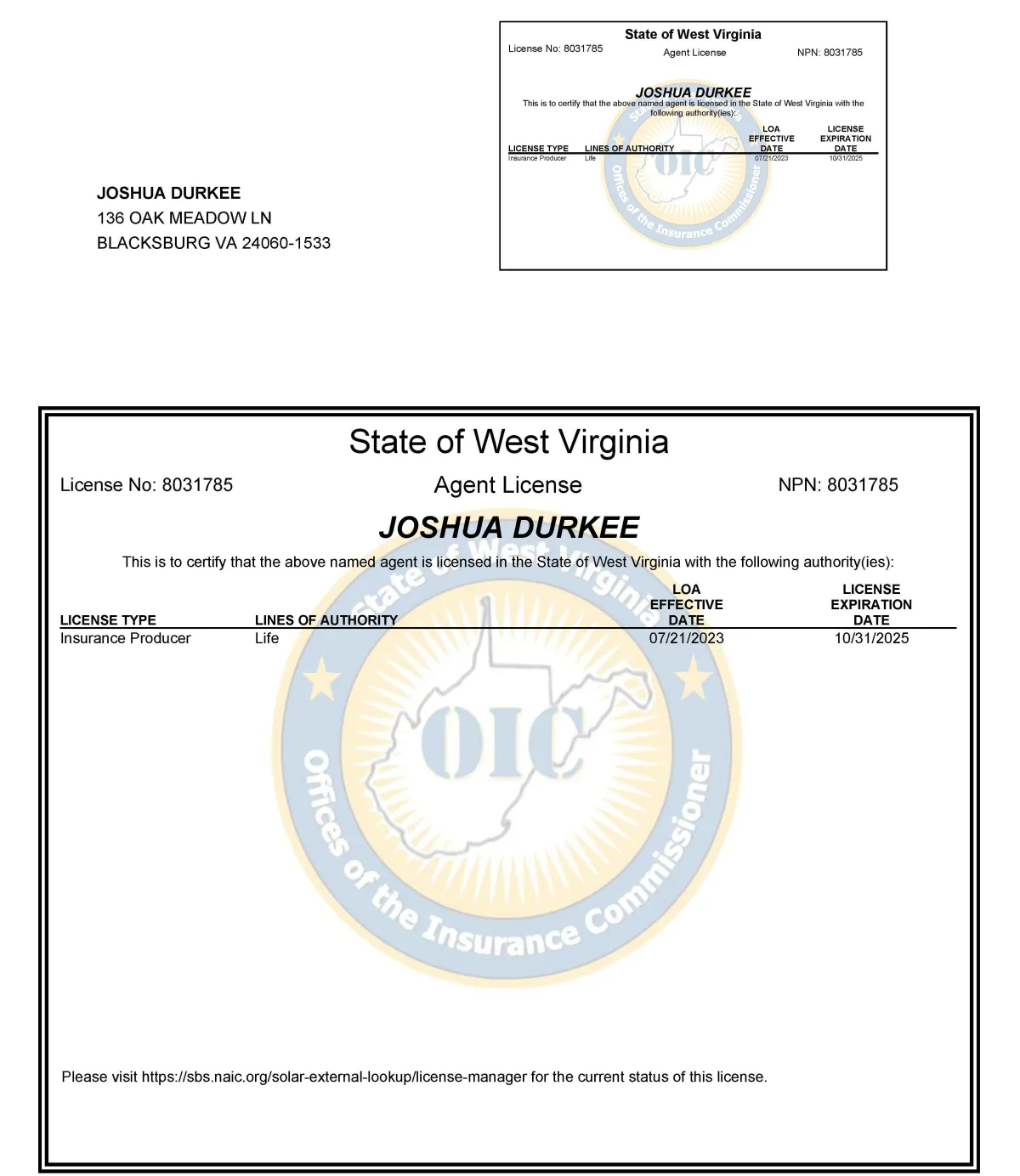

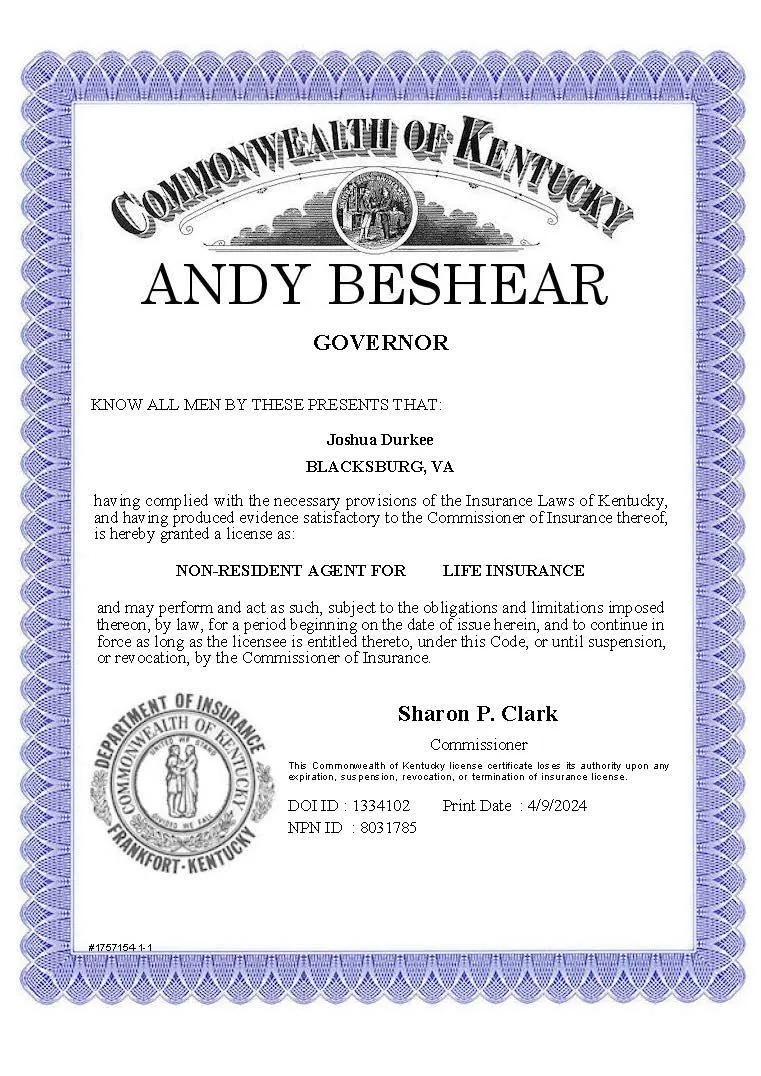

License Verification

National Producer #:8031735

Professional Organizations and Code of Ethics

Facebook

Instagram

X

LinkedIn

Youtube

TikTok